vermont income tax rate 2020

Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

Publications Department Of Taxes

Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

. 2021 Income Tax Withholding Instructions Tables and Charts - copy. The Vermont Single filing status tax brackets are shown in the table below. 575 plus local tax rate.

2017-2018 Income Tax Withholding Instructions Tables and Charts. Your 2021 Tax Bracket to See Whats Been Adjusted. TaxTables-2020pdf 27684 KB File Format.

Before sharing sensitive information make sure youre on a state government site. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. 2016 VT Rate Schedules and Tax Tables.

34 rows Annualized Income Installment Method for Underpayment of 2020 Estimated Tax by. RateSched-2020pdf 11722 KB File Format. Get Your Max Refund Today.

Vermont taxes most forms of retirement income at rates ranging from 335 to 875. 2015 VT and Tax Tables. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020.

Pay Estimated Income Tax by Voucher. 2022 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Meanwhile total state and local sales taxes range from 6 to 7.

Section 1326 of the Vermont Unemployment Compensation Law provides five different rate schedules each with twenty-one tax rates. Import Your Tax Forms And File For Your Max Refund Today. 2020 VT Tax Tables.

This includes Social Security retirement benefits and income from most retirement accounts. Ad Compare Your 2022 Tax Bracket vs. Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax bracket to 875 the highest Vermont.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. An Official Vermont Government Website. No change in the supplemental rate for 2020 per the Department regulation.

Find your gross income. The tax schedules are designed so that Rate Schedule 3 provides an equilibrium. Changes from 2019 are highlighted in yellow.

2015 Income Tax Withholding Instructions Tables and Charts. IN-111 Vermont Income Tax Return. Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021.

The gov means its official. Find your pretax deductions including 401K flexible account contributions. Tax Rates and Charts.

Property taxes in Vermont are among the highest in the nation but sales taxes are below average. Pay Estimated Income Tax Online. 2020 Vermont Tax Deduction Amounts.

A financial advisor in Vermontcan help you understand how taxes fit into your overall financial goals. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. State government websites often end in gov or mil.

Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax brackets. Tax Year 2020 Personal Income Tax - VT Rate Schedules. Get A Jumpstart On Your Taxes.

The appropriate schedule is determined by a special formula in the Vermont Unemployment Compensation Law. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. 2016 Income Tax Withholding Instructions Tables and Charts.

The Vermont Married Filing Jointly filing status tax brackets are shown in the table below. Detailed Vermont state income tax rates and brackets are available on this page. 80 for Maryland nonresidents and 32 for residents employed in Delaware.

Find your income exemptions. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. How to Calculate 2020 Vermont State Income Tax by Using State Income Tax Table.

Check the 2020 Vermont state tax rate and the rules to calculate state income tax. The state supplemental income tax withholding rates that have thus far been released for 2020 are shown in the chart below. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Discover Helpful Information and Resources on Taxes From AARP. W-4VT Employees Withholding Allowance Certificate. Vermonts tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living.

Vermont Tax Brackets for Tax Year 2020 As you can see your Vermont income is taxed at different rates within the given tax brackets. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. 2020 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

PA-1 Special Power of Attorney. There are a total of eleven states with higher marginal corporate income tax rates then Vermont.

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Calculator Smartasset

Publications Department Of Taxes

Vermont Sales Tax Small Business Guide Truic

Personal Income Tax Department Of Taxes

Vermont Retirement Tax Friendliness Smartasset

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design

Vermont Returns To Old Covid Guidance Drop Mask Mandates In Highly Vaccinated Schools Vtdigger

What To Know About Vermont S Property Transfer Tax Vhfa Org Vermont Housing Finance Agency

Publications Department Of Taxes

Personal Income Tax Department Of Taxes

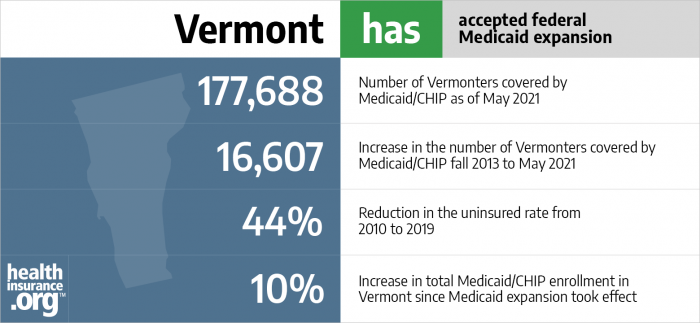

Aca Medicaid Expansion In Vermont Updated 2022 Guide Healthinsurance Org

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

Vermont Tax Forms And Instructions For 2021 Form In 111

Vermont Income Tax Brackets 2020

Filing A Vermont Income Tax Return Things To Know Credit Karma

United States Population Density Kids Encyclopedia Children S Homework Help Kids Online Dictionary The Unit Map Rural Landscape